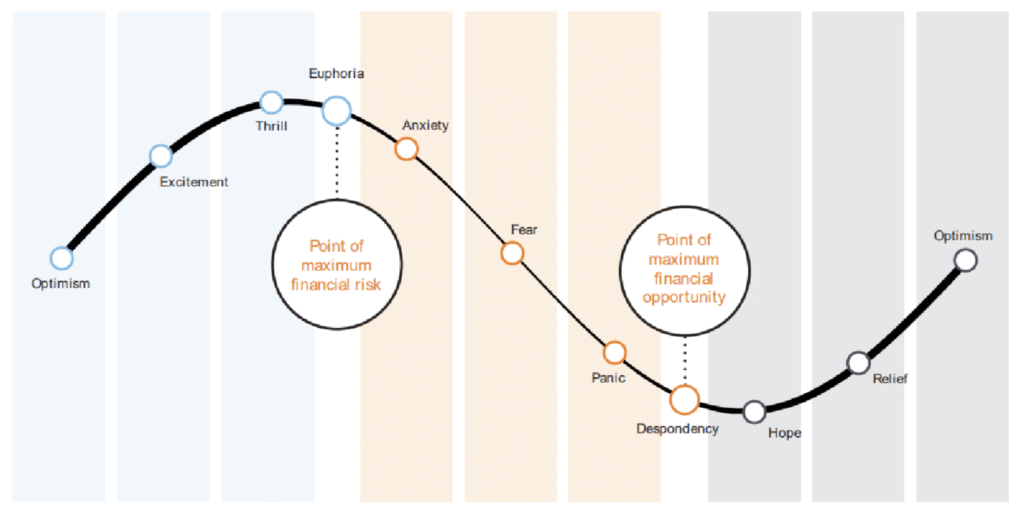

When things are great, we feel that nothing can stop us. And when things go bad, we look to take drastic action. Because emotions can be such a threat to an investor’s financial health, it is important to be aware of them. This awareness can then protect you from the negative consequences of impulsive and irrational reactions to these emotions.

Stage 1: Optimism, thrill and euphoria

Investors all start with optimism. We commonly expect things to go our way, or we end to expect a return for the risk of investing.

As expectations are met, it is common to get excited about the possibility of even greater returns and the excitement becomes thrilling as the returns exceed expectations.

At the top of the cycle is when investors experience euphoria. But it is here where investors are at the point of maximum financial risk. When we believe everything we touch turns to gold, we fool ourselves into believing we can beat the market, we cannot make mistakes, that excessive returns are commonplace and that we can tolerate higher levels of risk.

Stage 2: Complacency, denial, hope

The second phase of the cycle occurs when the market stops meeting our new lofty expectations and begins to turn. At first, we anxiously watch the market for any signs of direction. Anxiety turns to denial and then quickly to fear, as the value of the investments decline. Many people will then start to act defensively and may think about switching out of riskier assets to more defensive shares or other asset classes such as bonds.

Stage 3: Panic, capitulation, despondency

In the third phase of the cycle, the realities of a bear market come to the fore and an investor may become desperate. Many panic and withdraw from the market altogether – afraid of further losses. Those who persevere become despondent and wonder whether the markets are ever going to recover and whether they should be there at all.

Ironically, at these times, an investor will commonly fail to recognize they are actually at the point of maximum financial opportunity.

Stage 4: Skepticism, caution, worry

In the fourth stage of the cycle, investors may experience some skepticism when markets start to rise. They often have a sense of caution or worry, wondering if market growth will last.—and may be reluctant to invest money in the market at a point when prices are still relatively low and opportunities are attractive.

What are the consequences of this emotional roller-coaster?

Emotions turn rational investors into irrational investors. So it is important to remember that markets move and investments will always go in and out of favour.

Developed, diversified long-term financial plans are placed in jeopardy when investors are confronted by extraordinary events because we are guided by our emotions. This is where the role of the financial advisor is of utmost importance – your advisor can help you separate your emotions from reality and endeavour to steer you on the path of rational investing.

You can also help to avoid the emotional roller coaster by being aware of the emotions you are likely to experience. The five most common behavioural pitfalls are:

Overconfidence – when investors over-rate their ability to select winning shares or investment managers.

Loss aversion – research1 indicates a loss causes about twice as much pain as a gain causes pleasure. During periods of market volatility investors experience the sense of loss more acutely.

Chasing past performance – we see this time and time again, but unfortunately, individual investors who abandon a well-diversified portfolio for bonds, or even cash, may be jeopardizing their future financial security.

Timing the market – It is difficult to correctly predict the market’s movements.

Failure to rebalance – the risk/return characteristics of an investor’s portfolio should be independent of what’s happening in the market and this means selling high and buying low.*

The temptation to fall into one of these traps can be resisted by developing and committing to a well defined, long-term investment plan. This may be the best way to protect yourself from your emotions.

1 Kahneman, D. and Tversky, A. (1979) “Prospect Theory: An Analysis of Decision under Risk”

Diversification does not assure a profit and does not protect against loss in declining markets.

*As with any type of portfolio structuring, attempting to reduce risk and increase

return could, at certain times, unintentionally reduce returns. Rebalancing your portfolio may create tax consequences on the taxable portion.

Source: Russell Investments